Plug Power, $PLUG, looks to be showing potential for a move higher. I traded this one earlier this year and now it looks like its getting ready to move higher once again. There are a few things I like about this stock. First, it has held its 50-day moving average on its move higher. In addition, it has also shown support above the $10 range, which is the breakout level. Moreover, the weekly chart shows very constructive action. I took a position in this one today with a stop loss below the 50-day moving average.

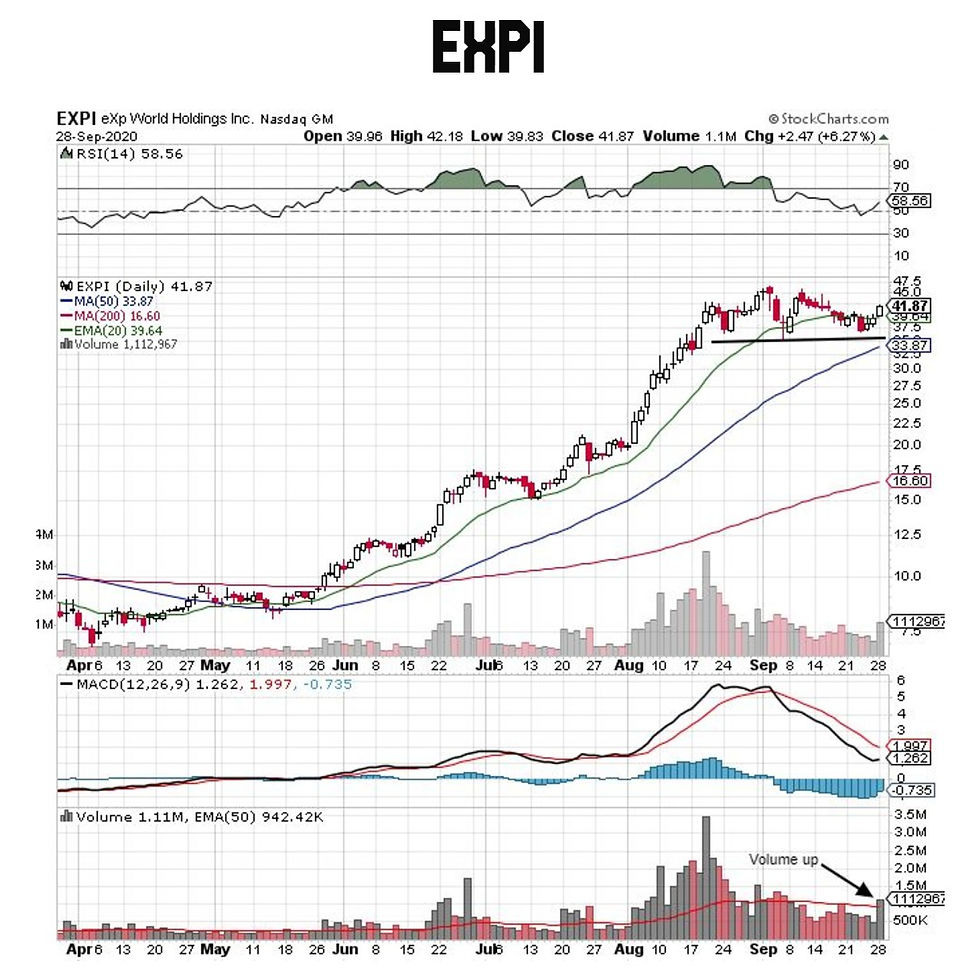

$EXPI has also been an explosive stock this year. I traded it for a very small gain earlier this year and have been kicking myself for months for not holding it for a much larger gain. I've been watching this one for quite a while and waiting for another entry. I took a position in this one today with a stop loss below recent lows. Like $PLUG, this one has a very strong weekly chart that looks like it may be forming a flag pattern. Time will tell.

Full Disclosure: EXPI and PLUG are stocks I currently own.

Disclaimer: This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained in this post constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned in this blog or the associated Twitter and Instagram feeds. The stock or stocks presented are not to be considered a recommendation to buy any stock or stocks. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.

Comments