Market Shows Signs Of Improvement

- TLivingstonBlog

- Mar 2, 2022

- 2 min read

Since major distribution hit the market in December, I have been content to remain mostly in cash. I've learned the hard way that "too much trading kills the trader." However, even though I have not been trading much, I have been closely monitoring the market for signs of a potential bottom.

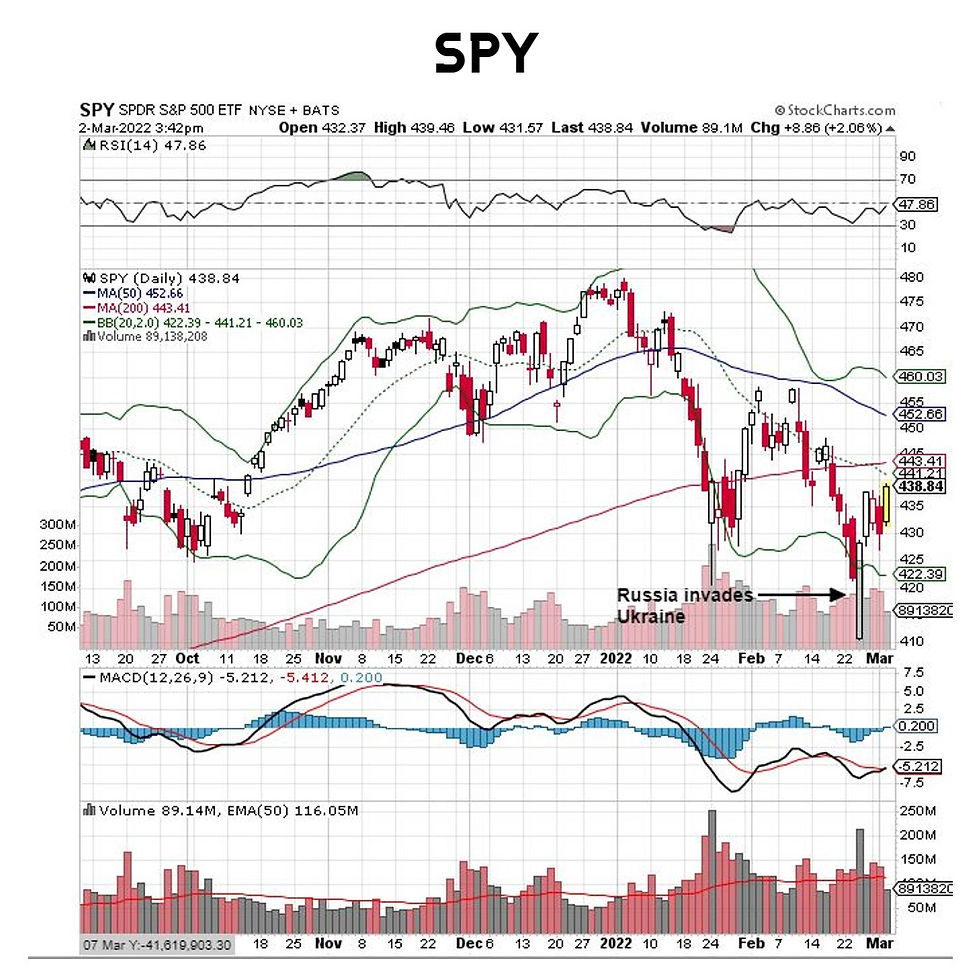

There are a few positive signs that have been occurring over the last few weeks. First, the news has gotten extremely bearish. The Russo-Ukrainian war is about as terrible as news can get. However, historically, the market often rallies at the start of major conflicts like this. Remember, markets often bottom when pessimism is at an all-time high. I recently created a short video discussing the sentiment around tops and bottoms that underlines the emotional extremes that are felt as the market turns.

In addition, the indexes have gotten extremely oversold recently. As Russia invaded Ukraine on February 24, 2022, the S&P 500 opened sharply lower and then closed high in its' range with volume coming in. Not only did this day undercut an important prior low, it also saw the S&P 500 open far below its' lower Bollinger Band. This is a sign that the market is drastically oversold at least in the short run.

Before I get aggressive, there are a few things I would like to see. First, I'd love to see some more fear hit the market. While the VIX has rallied towards 30, we haven't seen the mega-fear levels that often coincide with a bottom. While this is not a must, an elevated VIX above 38-40 for a few trading sessions would be a positive in my opinion.

In addition, I'd like to see some more participation among individual stocks. We haven't seen too many growth stocks breaking out recently, which is an important sign of market health. MU, DDOG, VRTX, and LYV are all on my watchlist as they have all held up really well over the past few months. If the market has indeed bottomed, it is always wise to keep an eye on the first stocks that are breaking out to new highs, as this is a sign of strength.

Risk right. Sit tight.

Disclaimer: This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained in this post constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned in this blog or the associated Twitter and Instagram feeds. The stock or stocks presented are not to be considered a recommendation to buy any stock or stocks. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.

Comments